State Of VC Funding In Africa

20 Aug 2024

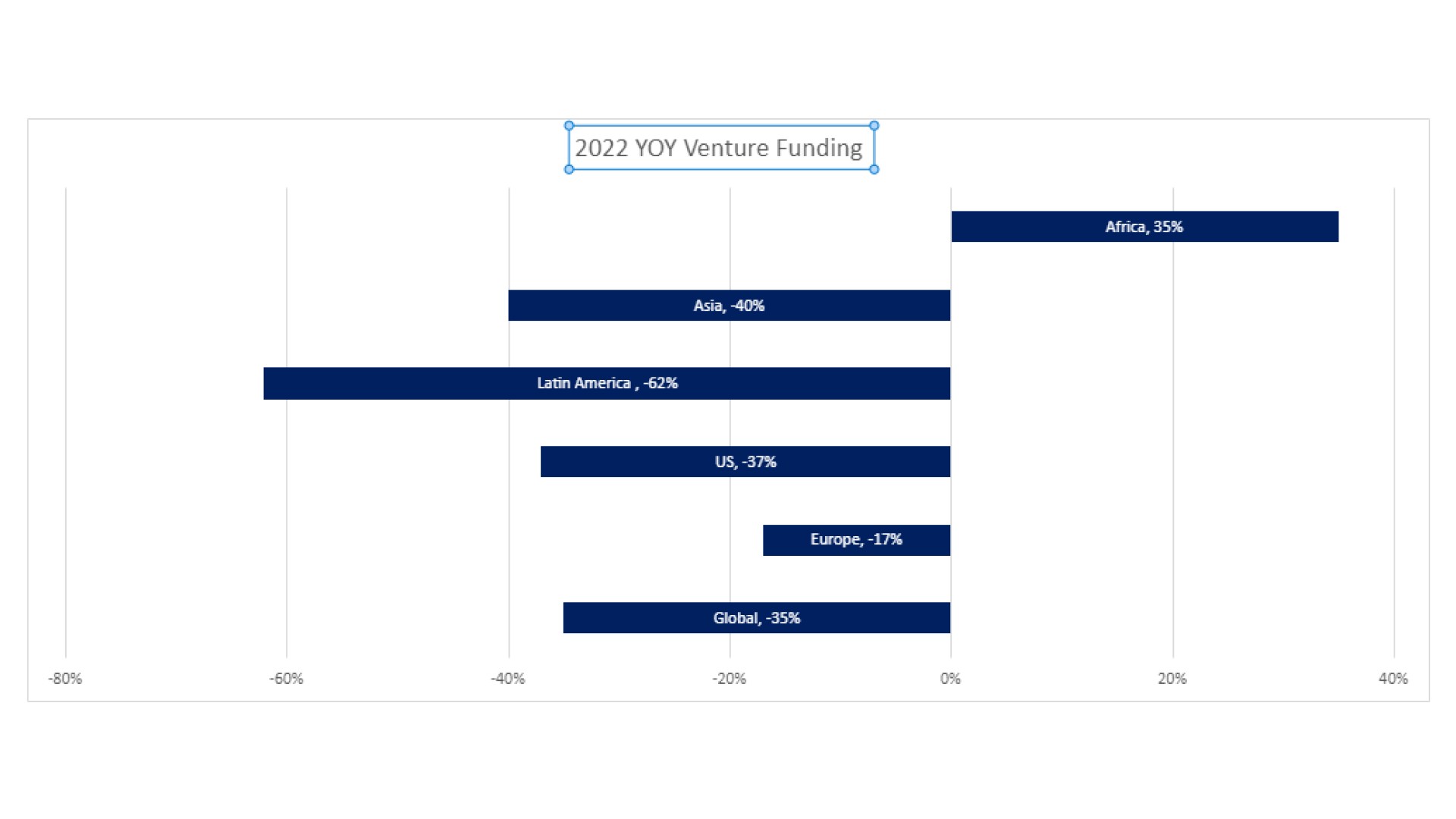

Global venture capital funding dropped in 2022 by 35% to $415.1B from the 2021 record of $638.4B; the highest recorded globally in the past 5 years. Recent patterns demonstrate that increasing inflation, rising interest rates, and austerity economic measures can be attributed to this significant drop. The global funding slackening was especially severe in the second half of the year. Illustratively, the United States saw a 37% decline in venture capital funding in 2022 compared to the previous year reaching $198.4B. Europe, Asia and Australia experienced a 17% ,40% and 24% contraction in startup funding, respectively. Further west, Latin America’s venture market also fell prey to this same downward cycle, and to a greater degree, recording a YoY contraction of 66% in 2022 coming in at $7.9B.

However, Africa's venture ecosystem defied the drift by demonstrating positive developments despite these unfavorable economic conditions. According to CB insights state of the venture report, VC (Venture Capital) funding in the continent reached US$3.1B across 570 deals in the year 2022, the strongest the continent has experienced thus far. Marking a Year-on-Year increase of 35% compared to 2021.

Source: CB Insights State Of Venture Report

Regional assessment and sector focus

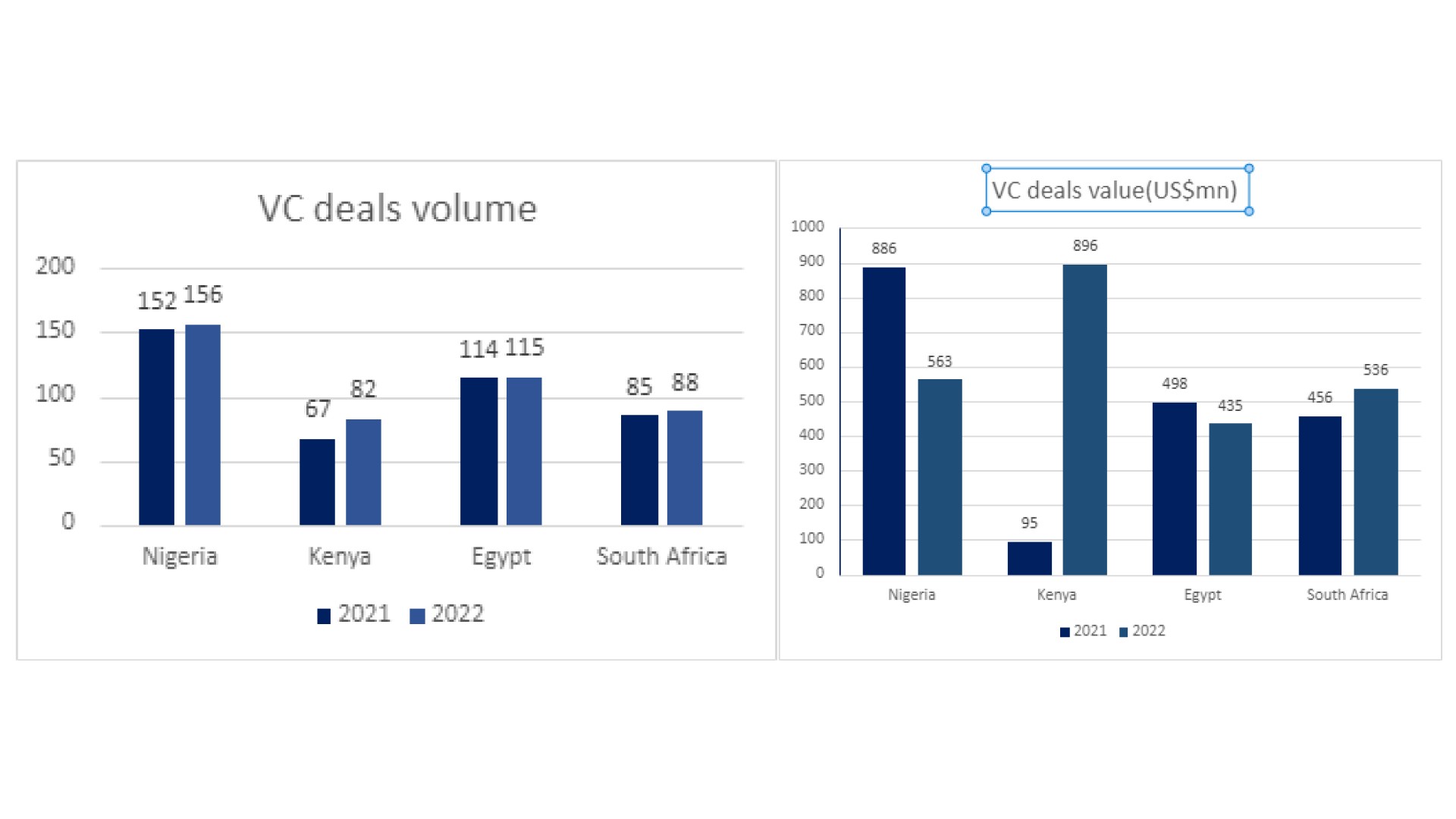

From a regional perspective, Egypt, Kenya, Nigeria, and South Africa dominated the venture capital share by volume and value in the continent. Kenya recorded the most significant growth in venture capital funding in 2022 as the deal value increased to 896 million, up from 95 million the previous year, indicating an 814% year on year (YoY) change. The number of deals in the country increased to 82, up from 67 the previous year.

Far North, Egypt saw a decline, albeit negligible in deal value from 498 million to 435 million as the number of deals increased by one to 115 from the previous year. Nigeria recorded a –36% YoY change in venture funding in value, clocking in at 563 million down from 886 million. Despite this significant decrease in value, the number of deals closed increased from 152 to 156 in the country. Down south, South Africa recorded a 17% YoY increase in venture funding by value to end the year at 536 million while the number of deals increased to 88 in 2022. Seychelles, Morocco, and Ghana are also did remarkably well in venture funding in the period under review.

Source: CB Insights State Of Venture Report

Notably, multi-region deals commanded an average of 10% of VC deal volume and a significant 44% of VC deal value in the first half of 2022. According to the African Venture Capital Activity report, the gradual but consistent increase in multi-region transaction activity is indicative of firms obtaining additional capital over time with a focus on regional development, and not necessarily because investors favor startups with a large geographic presence.

African entrepreneurs are developing a multi-regional presence across the continent by expanding their businesses directly and organically into new markets or by using mergers and acquisitions (M&A) as a vehicle for gradual regional growth. According to the CB insights state of venture report, the number of M&A deals rose 23% YoY from 79 to 97 in 2022. The bigger cheques typically associated with multi-region deals allow recipient startups to scale regionally and accelerate customer acquisition in existing markets.

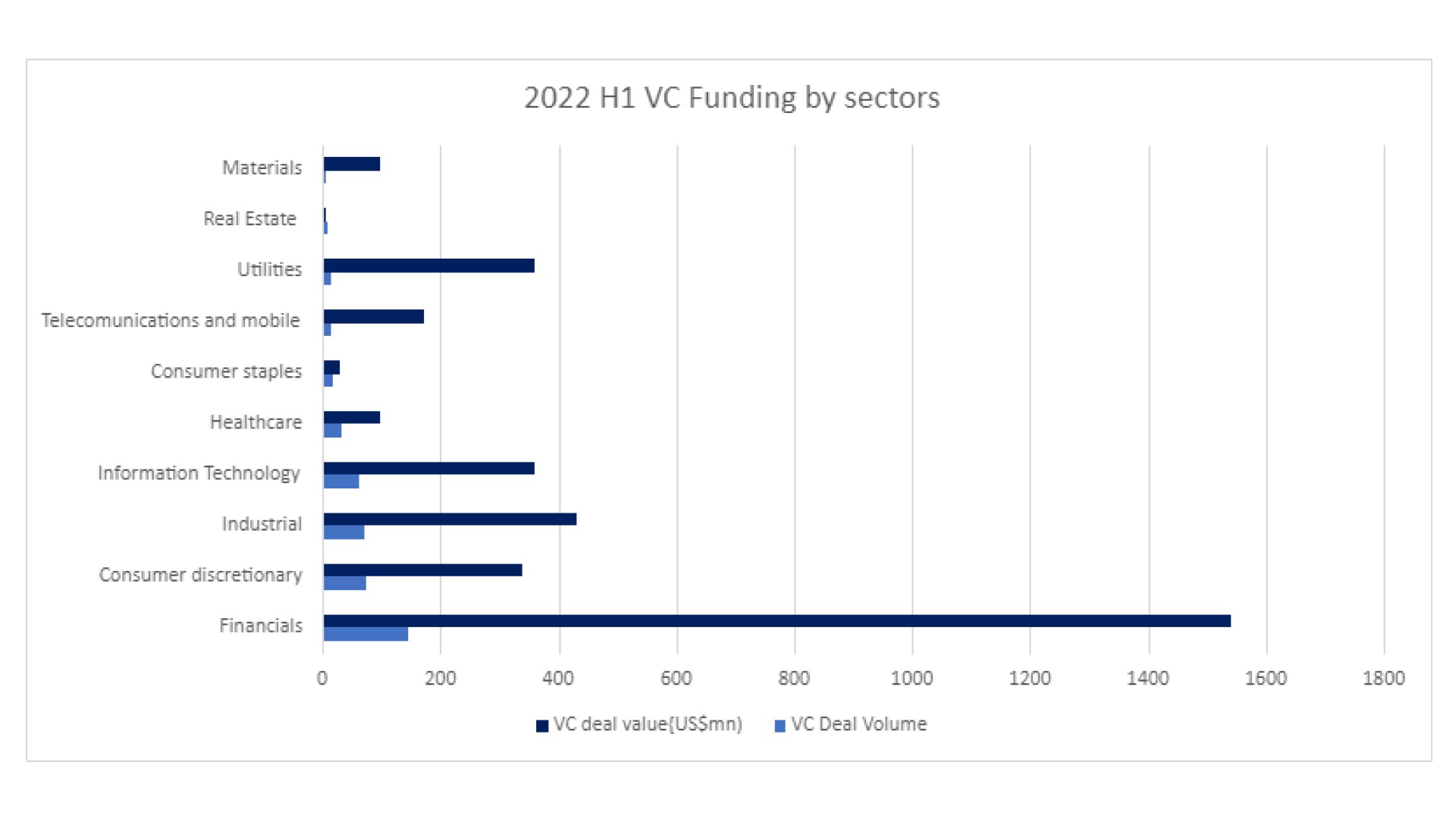

Looking at the continents venture capital market sector wise, Africa’s financial services industry attracted the biggest funding through FinTech companies, by both volume (32%) and value (44%), followed by Consumer Discretionary, which drew 17% of deal volume, overtaking Information Technology in the first half of the year. The Industrial sector emerged as the third most active sector by volume, accounting for 16% of the total number of Venture Capital (VC) deals that took place in the period.

According to the African mid-year report, recently previously marginalized sectors are becoming more mainstream; such as healthcare. According to the report, while the sector only accounts for 7% of the total deals in volume recorded in the continent in the first half of 2022, it remains a rising sector to look out for as the number of Health Care deals struck in the period have shown an increase in year-on-year development between 2020 and 2022.

The education sector has also experienced significant proliferation owing to the impact of the corona virus that disrupted normal academic systems prompting innovation in the sector. Illustratively, the number of EdTech startups that received VC Funding increased from 14 in the first half of 2021 to 23 in the first half of 2022, indicating a 64% change.

Source: CB Insights State Of Venture Report

Drivers for the growth

Three primary factors, according to research by the African Private Equity and Venture Capital Association (AVCA), lead to robust deal activity in the continent. To begin with, this growth in the African Venture capital market is the culmination of a deliberate attempt by African governments in recent years to foster a dynamic and enabling environment which encourages entrepreneurial efforts and enables investments to thrive.

Case in point is the Launch of Silicon Zanzibar by the Tanzanian government which aims to transform the island into a leading hub for Pan-African tech companies. Its three main initiatives include the provision of working and accommodation space in Fumba town; a new modern eco-town, issuing work Visas to Tech workers relocating to the Country and Zanzibar Free Economic Zone incentives such as a 10-year corporate tax break.

Secondly, Africa has been successful in terms of its organic recovery from the pandemic, compared to other regions of the world. Some of the factors that have contributed to this include:

Africa has had lower case numbers and death tolls from COVID-19 compared to many other regions of the world, which has helped to mitigate the economic impacts of the pandemic.

Many African countries were able to reopen their economies relatively quickly, allowing businesses to resume operations and people to return to work.

Africa has a strong agricultural sector, which was one of the sectors least impacted by the pandemic since food is a basic commodity; this helped to cushion the blow of the pandemic on the economy.

Many African countries have adopted adaptive strategies to the pandemic such as scaling up digital technologies and remote working, which has helped to keep their economies running.

Finally, is the depth of entrepreneurial innovation African countries have to offer. Most African companies address significant issues such as banking and energy. A mobile banking or edtech service is less likely to be discontinued in the event of an economic downturn compared to a fast-delivery service or investment app; which most startups in Europe or US are focusing on, therefore these businesses have been able to continue raising capital despite the global slump.

What lies in the future?

Africa’s innovative ecosystem has seen a highly eventful end to the year. It has been debated whether the industry is acting on borrowed time and whether its inflection moment is quickly approaching due to the global macroeconomic recession that has extended spells of lackluster growth and high inflation. These economic conditions have moderated the surplus of capital that swept the industry for two years.

Investors are no longer eager to take the risk of investing in startups as they can find better returns in more conservative investments like government bonds. Start-ups in Africa may therefore have to contend with a more challenging funding environment in 2023, with VCs (Venture Capital) focusing on unit economics and demanding that startups control and manage their capital and chart a route to profitability in the present market climate.

Additionally, Investors are also giving entrepreneurs in industries like renewable energy, block chain, and education more attention as opposed to previously mainstream industries like information technology. According to research by Crypto Valley Venture Capital, block chain firms in Africa raised $91 million in the first quarter of 2022, an increase of eleven times over the first quarter of 2021.

The other most active among technology or tech-enabled businesses that successfully received venture capital in the first half of 2022 was CleanTech. "CleanTech" refers to businesses that use or develop technology that aims to enhance environmental sustainability or to lessen the detrimental environmental effects of natural resources consumed by human activities as stated by African Private Equity and Venture Capital Association. The number of Cleantech deals will certainly increase in the years to come as more African entrepreneurs produce innovative, efficient, and sustainable solutions to urgent socio-environmental problems with the support of impact investors driven to support Africa's sustainable development goals.

In conclusion, if the previous year's venture capital funding statistics are anything to go by, we can undoubtedly anticipate more growth for the industry in the future; although Africa’s venture ecosystem is comparatively less advanced than its continental counterparts, representing just 1% of global venture funding. The ecosystem might inevitably be affected by the changing economic tides, however with agility and continuous support from the government, the future is anything but bleak. Additionally, the continent's solid market fundamentals, which continue to support growth, bode favorably for the long-term continuation of the rising tide of venture capital, fueled by the notion that investment prospects aplenty in Africa.