Impact Investment: The Landscape in East Africa

19 Aug 2024

What is Impact Investing?

“Impact investing” is a new investment category that has been getting a lot of play in the past few years. According to research by the financial times the amount of capital invested in impact has doubled over the last five years but what is it exactly? The most accepted definition of impact investing is investing with a specific objective of achieving positive social and/or environmental impact as well as financial return.

To be familiar with this type of investing it is necessary to place it on scale with other types of investing such as traditional investing, responsible investing, and sustainable investing. Traditional investing is investing with the sole purpose of financial return with no impact objective. Responsible investing filters out harmful investments like weapons or tobacco while sustainable investing is investing into companies that take in to account Environmental, Social and Governance (ESG) criteria for instance water and energy efficiency or a company with strong policies protecting their labor conditions still with a focus on the financial side of the investments.

Impact investing on the other hand carries forward the philosophy of not only do not doing harm but intentionally doing good which forms its essence. In as much as it is important to know what impact investing is, it is equally important to know what it is not. Impact investing is not an asset class, it is an investment approach across all asset classes, themes and geographies and has a full range of risks and returns for example an impact investment can range from a direct private equity investment in a fin-tech company providing access to finance to under-served populations to a loan supporting sustainable agricultural business to a share purchase in a sustainable forest fund. It is all about intentional impact and financial returns.

To look at the impact side a company ought to ask itself what its taste of good is and where they would want to create impact. This can be in services or in products provided such as building solar powered lamps for developing regions, developing natural products, or producing healthy foods. Impact can also be made in the way businesses are run or even on multiple levels such as honest working conditions, waste management or offering jobs to those who have fewer opportunities.

Due to the growing interest in impact investing across the globe, most asset managers have established impact investment platforms for their clients to evolve and diversify their investment offerings. TPG, KKR and Bain Capital have already launched impact funds and Goldman Sachs, UBS and US Bank have each added an impact investment platform to their asset management practices.

Outlook of Impact Investing in East Africa/Supply of Impact Investing

Today, the impact investing sector has grown into a global movement with thousands of organizations and billions of dollars invested worldwide. Africa’s investment case is compelling. Sustainable investment is an established niche in Sub-Saharan Africa, Philanthropy and the private sector are looking to social impact investing as an innovative approach to international development.

East Africa specifically is developing an organic approach to Impact Investing. Like other emerging markets, the East African private sector is expected to play a positive role in society which has led to a growing awareness that such investments can play an essential part in tackling the social and economic challenges in the region.

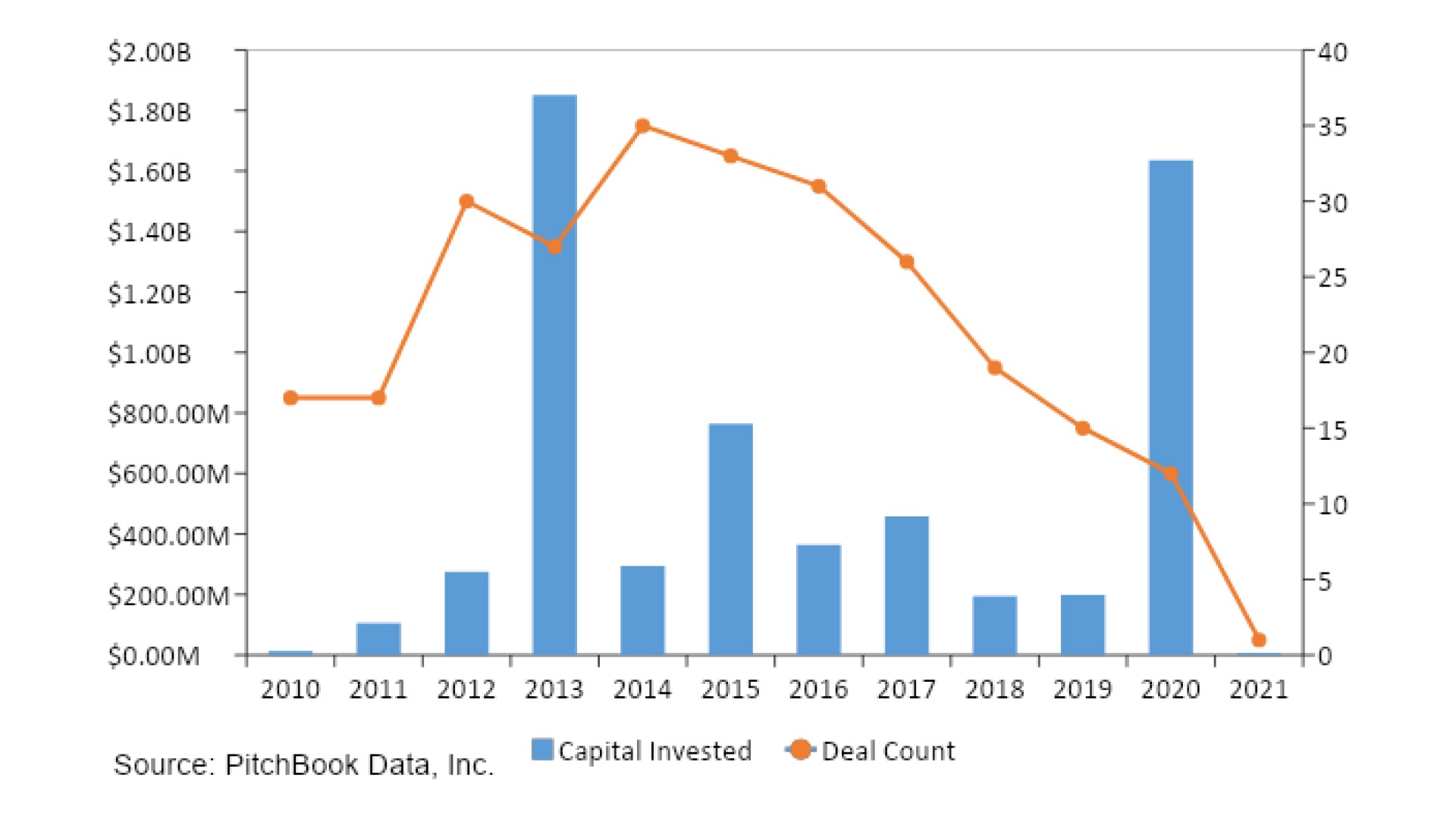

According to Pitchbook data, there are currently 316 impact investors spread through East Africa with 349 deals, 316 investors, 4 exits and investments in over 94 companies. The largest deal being a joint venture investment by BTG Pactual, Helios Investment Partners and Petrobras worth USD 1.57 Billion.

Figure 1: Capital invested and deal count over the past 12 years

In the East African region, Kenya remains the primary focus of impact investing given its possession of the largest concentration of impact investors and the most impact capital disbursed. According to the research done by The Global Impact Investment Network at least 136 impact capital vehicles are active in Kenya, Excluding DFIs, managed by some 95 impact investors with at least USD 240 million committed specifically to investments in Kenya. Despite Kenya being the most preferred country for both impact and conventional investors, it exhibits a few threats relating to ongoing concerns around the country’s security and political stability because of terrorist attacks from the Somali terrorist group, Al-Shabaab.

Uganda has experienced significant growth in their Gross Domestic Product over the past decade and the World Bank predicts that Uganda’s will open to new investment opportunities because of increase in their purchasing power parity over time. According to the research done by the Global Impact Investment Network, Uganda is the second largest impact investing market in East Africa, after Kenya.

It boasts the second highest number of deals, and second largest amount of capital disbursed in support of social and environmental impact with at least 119 impact capital vehicles active in Uganda, managed by some 82 non-DFI impact investors with at least USD 54 million committed specifically to investments in Uganda. There have been no noted significant country-specific impediments to impact investing in Uganda but rather that the primary challenge was a less favorable business environment than they perceive in Kenya alongside the existence of some adverse conditions like difficulty in acquiring talent and the presence of informal businesses which can compromise impact investors’ ability to place capital.

Rwanda has experienced an impressive era of rapid economic growth over the recent years. Its Asian Tiger-like model of state-led development and its reputation as the most efficient and least corrupt government in East Africa with the strongest rule of law has played a crucial factor in its growth. Impact investors have responded to Rwanda’s favorable business environment by listing Rwanda and one their key target countries and the same is reflected in the amount of impact investment activity to date with around 3% of all non-DFI impact capital disbursed in East Africa being placed in Rwanda, amounting to approximately USD 44 million. Despite its favourable investment environment, the allegations over Rwanda’s relations with paramilitary groups in the eastern DRC and its ethnic hostilities remain a major concern for the country, as well as a threat to its future as a market for impact investing.

Tanzania also forms a core part of the East African impact investing landscape and has become an increasingly popular destination. Despite positive trends, many adverse conditions persist in Tanzania such as the difficulty in sourcing talent, considerable number of informal businesses and the unpredictable nature and timing of government involvement in the private sector.

The country has the third largest number of impact investments in East Africa with at least 129 impact capital vehicles managed by 92 non-DFI impact investors that actively consider Tanzania with more than USD 2.5 billion in capital committed regionally could be deployed in Tanzania.

With the end of the civil war, Burundi is experiencing increased stability that may be suitably attractive to investors. To date, Burundi has seen limited impact investing activity with very few non-DFI1 impact investors operating in Burundi; however, DFIs have been more active, deploying more than 30 times the amount of capital that other types of impact investors have deployed in known deals. However, with a small total market size and limited economy, investors are less attracted to Burundi than to other countries in the region, as evidenced by limited FDI inflows. As such, only 23 known impact investment transactions have occurred in Burundi, 15 by DFIs and eight by non-DFI impact investors. Burundi has seen negligible impact investing activity with only a known USD 1.4 million has been invested through eight deals.

To date, South Sudan has seen negligible impact investment, but it could play a significant role as the country begins to develop independently. Investing and deploying capital in South Sudan continues to be challenging due to a variety of factors, including ongoing conflict, a poor regulatory environment, and a limited talent pool available to South Sudanese businesses. According to the research done by The Global Impact Investment Network, there are 50 known impact funds (excluding DFIs) that list South Sudan as part of their target geography who have deployed USD 748,000 in impact investments in the country to date. However, the country is still building an ecosystem capable of encouraging private sector growth by creating an enabling regulatory and service provider market as well as the general business environment.

Impact Investment According to Sectors in East Africa

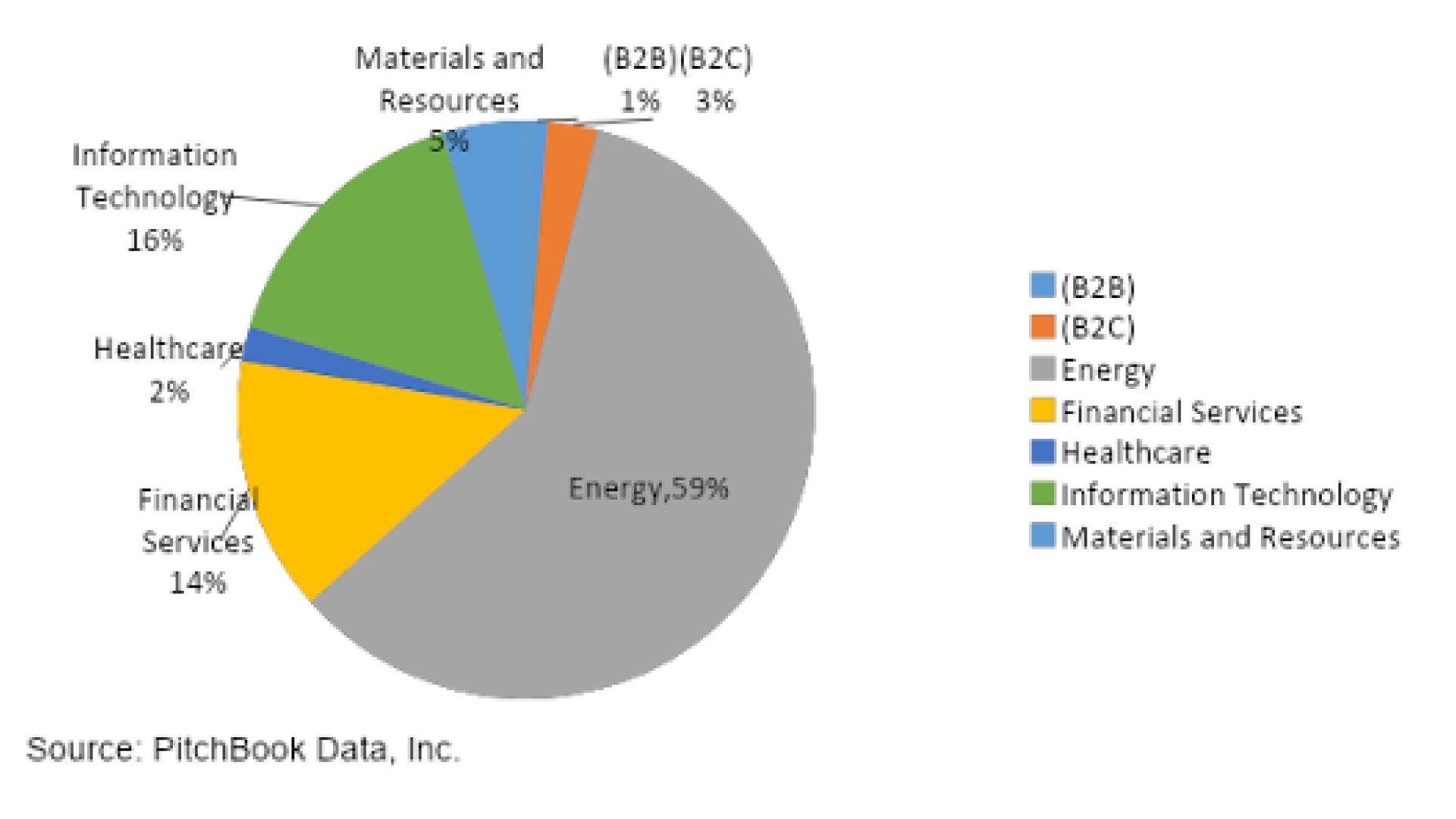

The distribution of investments by sector broadly reflects the impact of investor interest areas. According to the research done by The Global Impact Investing Network the sectors attracting the most social impact investment in East Africa are agriculture, energy, tourism, fast-moving consumer goods, and financial services. Pitchbook data reports that the sector that received most investments in the past two years in energy.

Figure 2: Impact Investment Capital Invested into Primary Industries in East Africa over the past 12 years.

Demand And Need for Impact Investing

In many developing countries, impact investors cite a lack of investment opportunities as an important obstacle for growing business. This is not the case in sub-Saharan countries, specifically East Africa. Projects are numerous, and considerable dynamism exists in the business at the bottom of the pyramid. Quality issues are more challenging. There is strong demand for impact capital from entrepreneurs operating in East Africa. Kenya is home to almost 50% more intermediaries, service providers, and other ecosystem players than any other East African country.

More than 30 different organizations operate to support impact investment in East Africa. The support ecosystem is primarily comprised of incubators and accelerators. There are also several business consultants, such as Open Capital Advisors, I-DEV International, Dalberg, and Biz Corps. Impact investors range from private equity firms, venture capitals firms, individual investors, NGOs, foundations, fund managers to DFIs.

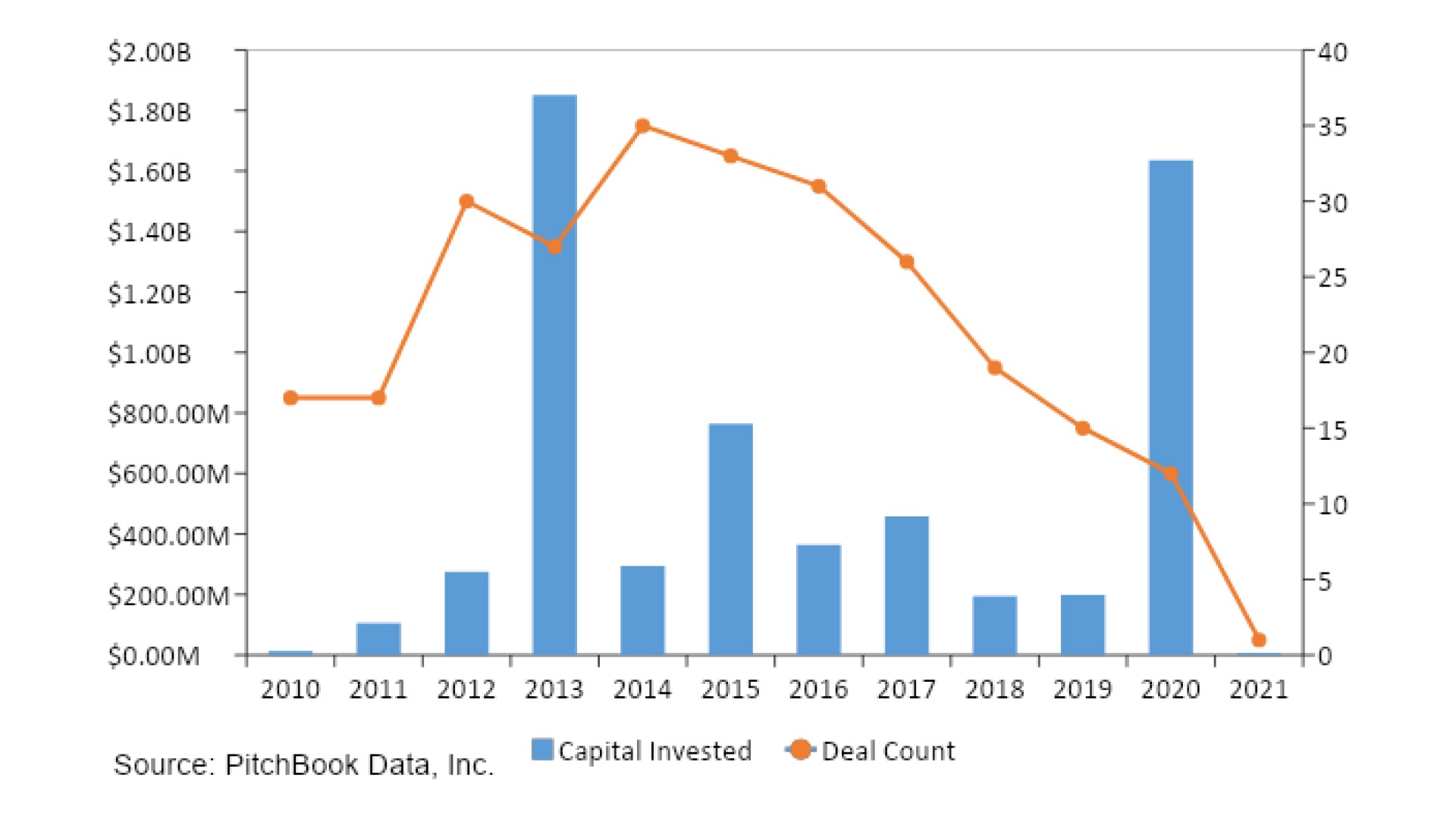

Figure 3: Internal Rate of Return of Different Types of Investments in East Africa over the past 12 years

Challenges

Like many emerging sectors, impact investment is struggling with inefficiencies as it grows and enters mainstream consciousness and investment practices. Despite dramatically increasing interest in raising capital to deploy in Kenya and the increasing number of deals completed each year, impact investors face a variety of challenges. These challenges, however, present opportunities for current impact investors, new impact investors, and other Eco-system players. The following challenges are commonly faced in East Africa:

There is scarcity of information on the financial and social performance of impact investments in the region. This requires establishing standard performance metrics for impact measurement to enhance transparency and allow benchmarking on fund performance. This in turn leads to a lack of credible and consistent reporting on impact which makes it difficult for investors to compare social, economic, and environmental returns of different investments.

Lack of capacity in Impact investing in terms of pipeline creation. There is need to help build a pipeline of “investment ready” firms to narrow the gap between investors’ appetite and absorption capacity for instance through increase in the number of incubators and additional funding into capacity-building infrastructure for the impact investing sector.

There is a large skill gap among entrepreneurs which is evident through the lack the education, skills, and access to information required to turn their entrepreneurial spirit into bankable project ideas.

Business owners are resistant to giving up equity due to lack of awareness of the implications of engaging equity investors.

There is a lack of incentives to convert from informal to formal business structures given the high operational costs involved, for instance licenses, taxes, and other operating costs.

Lack of flexibility in the investment products offered across the region that address the niche for smaller financing needs especially in the case of new ventures where the entrepreneurs’ funding needs are too small for traditional debt or equity financing.

The existence of restrictions that limit the growth of the impact investment industry, for instance the pension funds are not permitted to make private equity investments.

Lack of self‐identification as an industry. Industry is a very unfamiliar term to many investors and enterprises in the region and exhibits a potential conflict between institutions’ financial and social interests which results in a negative perception.

Lack of intermediaries to facilitate investments between investors and beneficiaries in the region makes finding and conducting deals more complex for potential investors, for instance syndicators, market intermediaries and clearing houses.

Long due diligence process and lack of data on financial and non‐financial performance during the due diligence stage which affects the deal making process and presents a challenge to investors and lenders, as there is no source of comprehensive information on credit histories.

Lack of options for exit because of the nature of the region’s capital markets which limits the initial public offering (IPO) options available to investors which forces investors to use strategies like sale to sponsors, self‐liquidating structures, and trade sales.

Opportunities/Recommendations on How to Address the Challenges/Actions to Support Impact Investing in East Africa

Despite challenges, there are many opportunities for impact investors to operate in East Africa and leverage return-seeking investments to drive job creation, economic development, and opportunities for disadvantaged populations. Opportunities for impact investors include the following:

Leverage technical assistance (TA) facilities for pre-investment pipeline building that will get companies to the point where they can successfully raise capital. This will also reduce due diligence timelines if the investor can increase familiarity and visibility into the business pre-investment.

Development of sector expertise through the understanding of specific sectors where their portfolio companies operate which will assist the investors to identify exciting, less well-known opportunities earlier and reduce their diligence timelines by leveraging existing knowledge.

Increase local decision-making by increasing local support where possible as this allows the investment officers to form meaningful relationships with portfolio companies. By placing local staff and investment committee's investors will be able to also reduce diligence timelines, as these individuals are more familiar with local trends and norms.

Source opportunities outside capital cities to locate entrepreneurs operating in rural areas especially in the case of impact investors who operate in different sectors.

To tackle the lack of education and research challenge, conferences and workshops should be used to bring together impact investors and social entrepreneurs which can act as an opportunity to clarify concepts and highlight success stories.

Link with the global network Initiatives to build the impact investing industry which will provide access to other impact investors internationally and gateways to new markets, buyers, and suppliers.

Development of new financial products suited to the needs of smaller enterprises, increasing technical assistance, standardizing equity investments and reduction of the substantial risk of investing and the high transaction costs.

Impact investors should work with policy makers to strengthen the industry Policy initiatives that nurture the growth of impact investing in East Africa through initiatives that focus on expanding the sector and impact investing capital.

Investors should build awareness and knowledge products on impact investing potential and success stories. Initiate or leverage information portals and networks to learn the concerns of stakeholders, create round tables, and disseminate essential information.

Investors should foster innovative Collaboration to build the ecosystem through consultation networks, information and investment platforms which will in turn address the fragmentation of the market.

Conclusion

This paper has sought to present a comprehensive assessment of the impact of investing in East Africa. It has laid out a series of steps that can be taken to facilitate the growth of impact investing in the region. The first step to realizing the potential of impact investing in East Africa is to tackle the challenges to create a conducive environment to facilitate impact investment activities. Should the challenges be appropriately addressed, many social, environmental, and financial benefits are to be derived from impact investing. The industry must also be realistic about the return it will offer and investment products it must develop to become a viable proposition for entrepreneurs. The growth of the private sector and the resulting social, economic, and environmental impact will come down to the creativity and integrity of the stakeholders.