Dollar Appreciation And Its Impact On Kenya's Economy

19 Aug 2024

The DXY index, an index that measures the weighted average of the dollar's value against six major currencies is at a 20 year high, having appreciated by more than 20 percent against the yen, more than 13 percent against the Euro and 6 percent against emerging market currencies in the year 2022. In comparison to the Kenyan shilling, the greenback has been appreciating just as strongly. As of 31st December 2022, the US dollar was trading at 123.375 Kenyan Shillings, up from 113.141 at the end of 2021, indicating 9% change.

Although several factors have contributed to this significant move, much of it reflects the United States Monetary Policy Committee efforts to tackle inflation. A series of interest rate raises has turned the currency into a high yielding currency. These lofty interest rates draw global capital as investors seek higher returns increasing its demand thus pushing the dollar up.

The Russia-Ukraine war has also majorly contributed to this appreciation. Russia's war of aggression against Ukraine set off an oil and food prices shock that has continued to fuel inflationary pressures, sapping consumer confidence and family spending power. The possibility that prices will remain higher for a much longer period is increased by the conflict's escalation. This heightens the danger of persistently high inflation raising the likelihood of stagflation and societal instability in both developed and developing nations like Kenya.

Following most people's perception of a relatively stronger economy in the United States, that will be less adversely affected by this war compared to other countries, the demand for U.S. assets increases leading to a stronger dollar. Moreover, diesel and petrol prices continue to rise domestically as they trail global crude oil prices exerting more pressure on the Kenyan shilling.

While these two global factors are the major drivers of the dollar appreciation, some local factors have contributed to this depreciation of the Kenyan currency. According to the KNBS 2022 Economic Report, "the faster growth of imports compared to exports resulted in a widening of the balance of trade deficit from KES 999.9 billion in 2020 to KES 1,407.6 billion in 2021. Earnings from total exports could only cater for 34.6 per cent of the country’s imports, during the year under review." Since the dollar is the most overwhelmingly the used currency in global trade, its value appreciates relative to the Kenyan Shilling when the demand for Imports increases relative to exports.

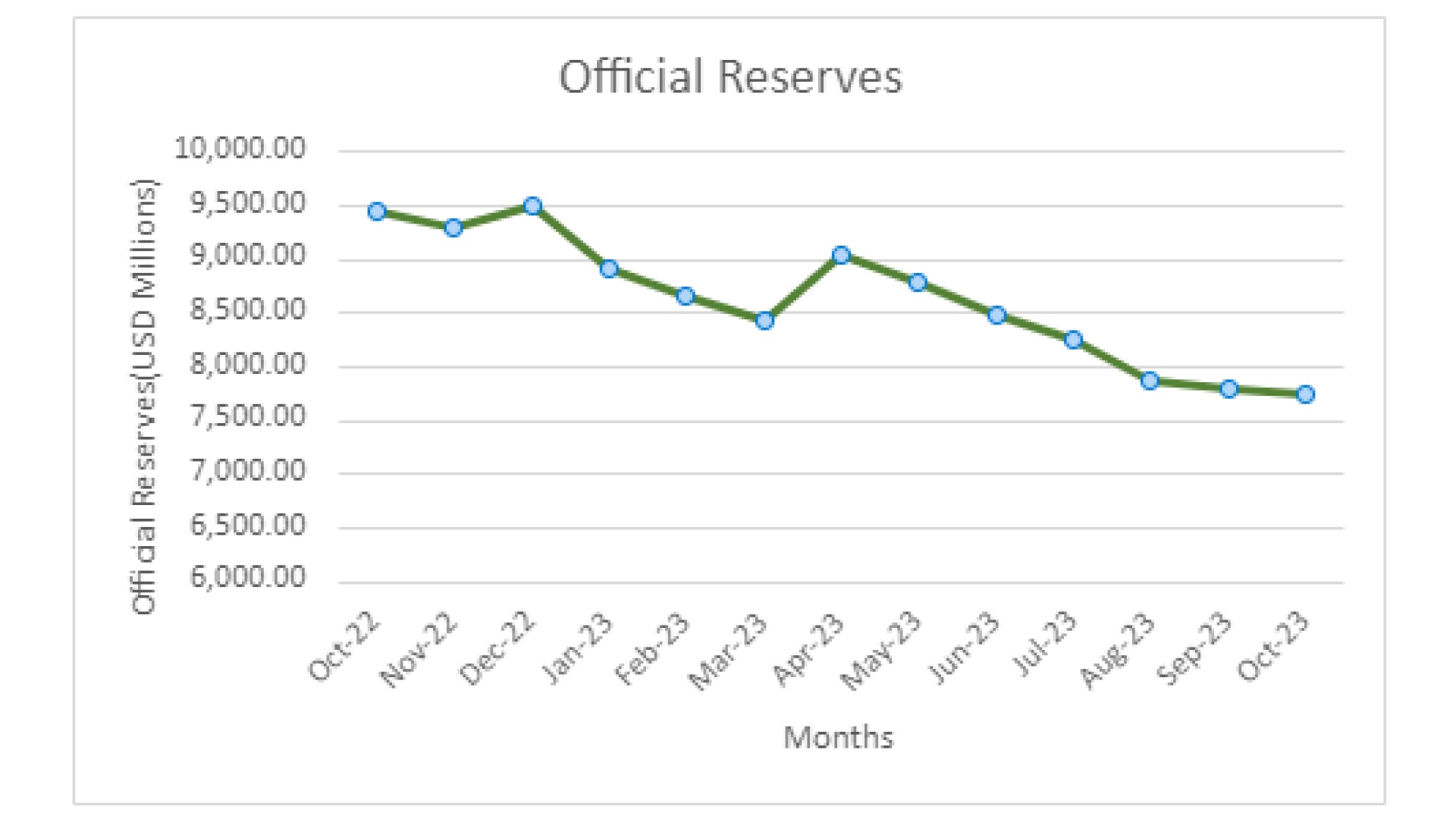

Secondly, according to the CBK annual report& financial statements 2021/22, Kenya's Reserves fell from $9.4 billion in October 2021 to$7.7 billion in 2022.

Foreign Exchange Reserves (End of Period USD Million)

Source: Central Bank of Kenya

Foreign exchange reserves are used by Economies to maintain a stable exchange rate, price exports competitively, maintain liquidity and investor confidence. All of which influences the exchange rate. They also require reserves so they can pay their loans to other countries, afford to invest in broad portfolios, and finance various parts of the economy. To stem the shilling's depreciation against the dollar and repayment of bilateral and commercial lenders, the reserves have declined further.

This drop in forex reserves remains a concern for the government as it could accelerate the depreciation of the shilling. Nonetheless, the central bank in its report maintains that the official foreign Exchange Reserves in the 2021/22 fiscal year remained above the statutory requirement of a four months of import cover and this continues to provide an adequate buffer against any short-term shocks in the foreign-exchange market.

This greenback boom is a brewing doom loop for many countries fighting to bring down inflation and stabilize their economy. The appreciation of the US dollar increases the cost of goods and services purchased from abroad resulting in inflation and decreased purchasing power. This causes a decrease in the value of the local currency and reduced competitiveness of local exports which in turn slows down economic growth. Hardly hit, is Kenya due to its Import dependency and its greater share of dollar invoiced imports. Moreover, this dollar appreciation is reverberating through balance sheets around the world.

Half of all sovereign debt is dominated in the dollar. This spells doom for Kenya and other HIDCs since the US dollar appreciation increases the total amount of debt owed and results to higher interest payments. In addition, the US dollar appreciation makes it more difficult for countries like Kenya to access capital markets and can lead to a decrease in foreign direct investments since investors are less likely to invest in these countries, as they may not be as confident in the stability of their local currency.

For instance, Kenya's government called off the planned $1.1 billion Eurobond issuance for the fiscal year (2021/2022) due to weak market circumstances, which reflected the general world-wide aversion to taking risks. A decline in FDIs will in turn reduce the amount of funds available to service a country’s debt. The appreciation of the US dollar is also making it more expensive for developing countries like Kenya to borrow from abroad, as the cost of servicing the debt increases.

This can further limit their ability to invest in infrastructure and development projects, which are essential for their long-term economic growth which exacerbates the situation. These factors combined raise the risk of defaulting on debt payments if the cost becomes too high for the country to bear as is in Zambia's case.

However, not all is lost, several measures can be adopted to mitigate the situation, some of which the government is already undertaking. Governments often react to currency pressure by intervening in the foreign exchange market and altering domestic interest rates. As foreign reserves slipped below the four months' statutory import cover threshold in November 2022, the Central Bank's monetary policy committee increased its policy rate from 8.25 percent to 8.75 percent, in response to the mounting pressure on the government to fulfill its international responsibilities.

The logic being that by making domestic investments more attractive, the currency will strengthen. Typically, central banks also intervene in the foreign exchange market by buying and selling currencies to contain excessive fluctuations. Most countries are resorting to foreign intervention as in the first seven months of this year, the total amount of foreign reserves held by emerging markets and developing nations decreased by more than 6% according to IMF.

Considering the lessons from previous crises, emerging market central banks have accumulated dollar reserves recently; nonetheless, these buffers are finite and should be used judiciously. To deal with probable future unrest and harsher outflows of capital, countries must maintain essential foreign exchange reserves.

The IMF recommends that foreign exchange intervention should not be used to replace necessary adjustments to macro- economic policies. The best course of action is to let the exchange rate fluctuate. The higher price of imported products will aid in the necessary adjustment to the fundamental shocks. Monetary policy measures should be employed to keep inflation near to the target given the importance of fundamental drivers. In addition, the organization suggests that the most vulnerable in society should be supported by fiscal policy without endangering inflation targets. Beyond the existing preventative finance options for qualified nations, the IMF is prepared to offer lending resources to its members who are having balance of payments issues.